Job, Good Economy Push Mortgage Delinquency Levels to Pandemic Low

March's mortgage delinquency rate was at its lowest point since the pandemic-driven economic upheaval began approximately one year ago, CoreLogic's Loan Performance Insights Report found.

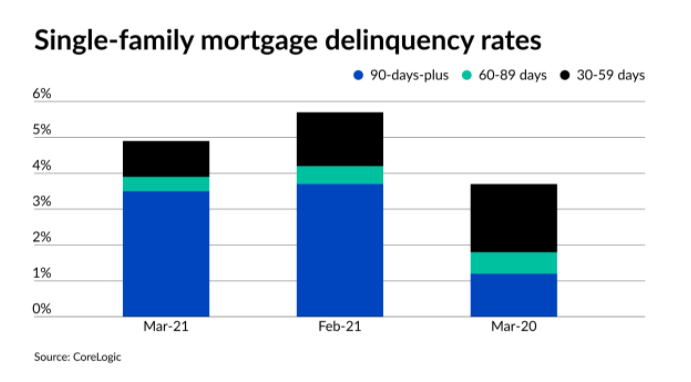

The 4.9% overall delinquency rate was still 1.3 percentage points higher than March 2020's delinquency rate of 3.6%, but on a month-to-month basis, the delinquency rate fell 80 basis points from February's 5.7%. In January, the rate was 5.6%, while in December, it was 5.8%.

"Many forces came together in March to yield the largest one-month improvement in the overall delinquency rate since the pandemic started," said Frank Nothaft, CoreLogic chief economist, in a press release. "In addition to continued government support, including stimulus payments and mortgage forbearance programs, the U.S. economy added 770,000 jobs in March, the largest increase since August of 2020."

Loans in all of the delinquency buckets — except for those that are more than 90 days out since their last payment or in foreclosure — fell compared with March 2020. March's seriously delinquent mortgage rate of 3.5% was more than 2.3 percentage points higher than one year ago, when it was at 1.2%. It is 20 bps lower when compared with February's 3.7%.

Short-term delinquencies, defined as loans between 30 days and 59 days late on their payments, saw the biggest improvement, at 1% in March, versus 1.9% one year prior. Compared with February, there was a 50 bps improvement from 1.5%.

In another positive development, the rate of current loans transitioning to the 30 days or more late category improved in March to 0.4%, from 0.9% in February and 1% in March 2020. "Homeowners are catching up on their debt as the economic effects of the pandemic begin to wane, which is yet another sign of forward motion on the road to overall recovery," said Frank Martell, CEO and president of CoreLogic...