As Home Prices Rise, Attention Turns to Affordability

Overall HPI Growth

National home prices increased 10.4% year over year in February 2021, according to the latest CoreLogic Home Price Index (HPI®) Report. The February 2021 HPI gain was up from the February 2020 gain of 4.3% and was the highest year-over-year gain since April 2006. Low mortgage rates and low for-sale inventory drove the increase in home prices; however, affordability constraints may work to slow home price growth later this year, especially as mortgage rates increase.

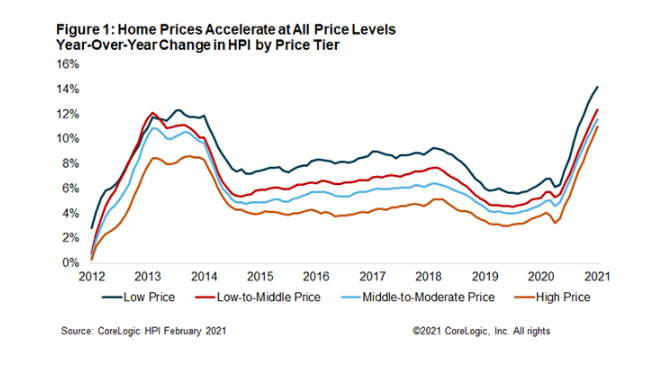

HPI Growth by Price Tier

CoreLogic analyzes four individual home-price tiers that are calculated relative to the median national home sale price.[1] Home price growth accelerated for all four price tiers to the highest rates since 2005 for the low-price tier and since 2006 for the other three price tiers. The lowest price tier increased 14.2% year over year in February 2021, compared with 12.4% for the low-to-middle price tier, 11.6% for the middle-to-moderate price tier, and 11% for the high price tier.

Entry-level homes in high demand by first-time buyers are in short supply, leading to affordability pressures for these buyers. Lack of affordability is exacerbated by increases in mortgage rates, which further increase monthly mortgage payments. For example, the 30-year fixed-rate mortgage rate has increased about a half a percentage point since hitting a low in January 2021.

State-Level Results

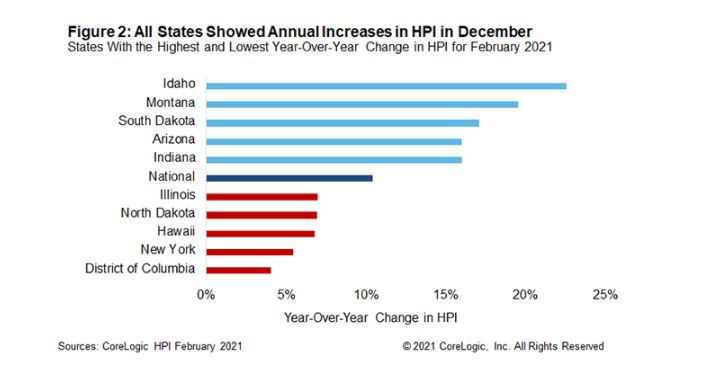

Figure 2 shows the year-over-year HPI growth in February 2021 for the 5 highest- and lowest-appreciating states. All states showed annual increases in HPI in February, and Idaho led the states with appreciation of 22.6%, nearly double the rate of appreciation from a year earlier. At the low end, Washington, D.C., saw an increase in home prices of 4%.

The surge in home price appreciation was felt across the country, with all states showing higher appreciation in February 2021 than in February 2020. Connecticut and Montana had the biggest acceleration in home price growth from February 2020 to February 2021. Connecticut is notable because prices were falling by 0.6% in this state in February 2020 but increasing by 14.8% in February 2021. This turnaround can be partly attributed to an influx of buyers from metropolitan areas in nearby states.