Texas Housing Insight

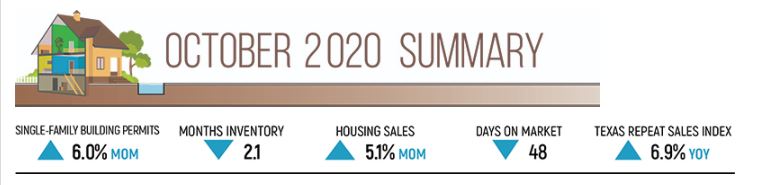

Total Texas housing sales increased for the second consecutive month, rising 5.1 percent to exceed 38,600 seasonally adjusted transactions. Historically low mortgage interest rates contributed to robust demand, pulling the state's average days on market to a record low of 48 days. Building permits and housing starts suggested construction activity will pick up in the coming months, but current inventory is extremely depleted, and bank loan data indicated residential investment slowed during the third quarter. With homes flying off the shelf at the present rate, the housing supply would last just 2.1 months if no additional listings entered the market. Constrained inventory contributed to double-digit growth in the median home price as the composition of sales shifted toward higher-priced houses. The Real Estate Center's Repeat Sales Home Price Index also accelerated, albeit at a more moderate pace, threatening recent improvements in affordability. The pandemic and the associated economic uncertainty remain the greatest headwinds to the Texas housing market, and survey data indicated the proportion of Texas mortgagees at risk of foreclosure in the coming months increased relative to the prior month. Moreover, the Real Estate Center projects a step back in single-family sales during November.

Supply

The Texas Residential Construction Cycle (Coincident) Index, which measures current construction levels, flattened as industry wages and construction values moderated, offsetting a modest uptick in employment. The Residential Construction Leading Index rose for the sixth straight month amid increased housing starts and a decrease in the real ten-year Treasury bill, although multifamily building permits stumbled. At the metropolitan level, the leading indexes also trended upward.

Recently released third-quarter private bank loan data revealed a slowdown from last year's rapid clip as lending standards continued to tighten during the pandemic and an uncertain economic outlook. Loan values for multifamily properties flattened in 3Q2020 while one- to-four-unit investment declined for the second straight quarter, sinking 6 percent quarter over quarter.

On the bright side, single-family construction permits accelerated 6 percent in October, marking the sixth straight monthly increase after the previous month's reading was revised upward. Houston topped the list, issuing 4,492 nonseasonally adjusted permits, followed by Dallas-Fort Worth with 4,243 permits. The metric in Central Texas reached 2,019 and 1,064 in Austin and San Antonio, respectively, pushing monthly growth to nearly 10 percent after adjusting for seasonality. On the other hand, Texas' multifamily permits fell 6.3 percent year-to-date (YTD) compared with the same period last year due to a considerable step back in the volatile apartment sector. Issuance for two-to-four-unit buildings, however, posted an all-time high of 1,083 nonseasonally permits, largely due to new duplex developments in North Texas...