Behind the Paradox of Rising Mortgage Delinquencies Amid Rising Home Prices

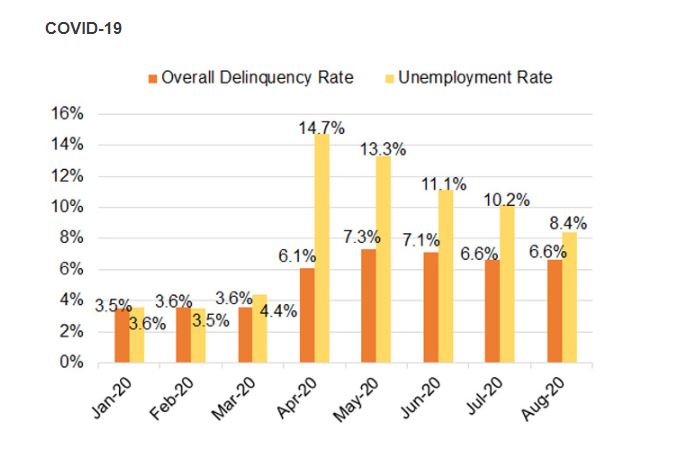

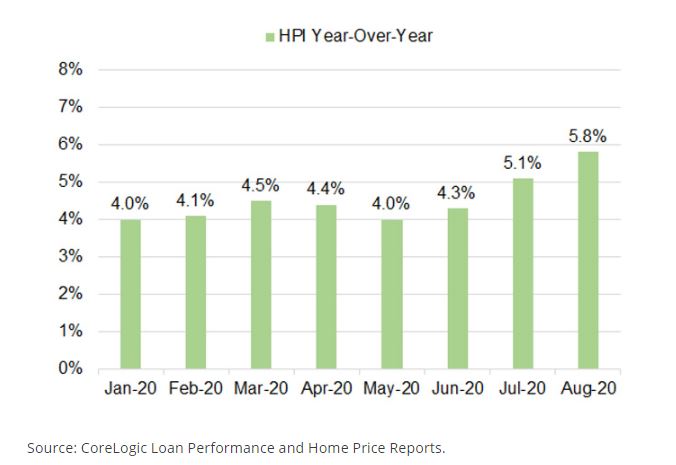

Recent loan performance data from CoreLogic shows that the nation’s overall mortgage delinquency rate – the proportion of mortgage loans falling 30 or more days behind scheduled payment, including loans in foreclosure – have risen quickly during the COVID-19 pandemic, as millions of Americans lost their jobs and income due to the economic shutdown. As the job losses piled up – in April alone, more than 22 million of Americans filed unemployment claims, or 14.7% of the civilian labor force – many homeowners struggled to keep up with their mortgages: the overall mortgage delinquency rate rose from 3.6% in March to 6.1% in April and by May, to 7.3% – more than doubling from the pre-pandemic levels. Meanwhile, as low interest rates fueled strong housing demand, home prices continued to surge with the growth accelerating through the crisis. See Figure 1.

It may appear paradoxical that mortgage delinquencies and home prices have moved in the same direction.[1] It is true that mortgage defaults and home prices do typically go hand in hand, but just not in the same direction as we’ve seen in the current pandemic. And unlike the last mortgage crisis when home prices collapsed due largely to risky subprime and low/no-doc mortgages that fueled an unsustainable asset bubble bound to burst, the COVID-19 and the shocks it sent through the economy and housing market are entirely exogeneous – not to mention that at the onset of the pandemic, homeowner’s equity was at all-time highs. And thanks to the U.S. federal government’s swift response at the onset of the pandemic, the mandates from the CARES Act have allowed homeowners experiencing a job loss or pandemic-related financial hardships to defer and delay mortgage payment.

At the height of the pandemic, approximately 9.7% of the loans in servicing sought forbearance protection in April alone. But with many borrowers falling behind on their payment, mortgage delinquencies began to rise. In fact, if one takes a closer look at the pandemic delinquent loan pool, it becomes apparent that the majority are indeed loans under payment forbearance but have a missed payment.

While the delinquent loans in forbearance are treated as though they were current under the mandates of the CARES Act, any missed payment will nevertheless continue to result in a status update by servicers to indicate a loan’s de facto payment status each month. Consequently, as many borrowers in forbearance fall behind payment due to job losses or financial hardships, the loans become “technically delinquent” on servicers’ book and hence part of the tally going into reported mortgage delinquency measures...