Holding Steady: Foreclosures Remain Low While Serious Delinquencies Continue to Build Up

- The U.S. 150-day delinquency rate reached its highest level since at least January 1999

- Forbearance provisions have helped foreclosure rates maintain historic lows

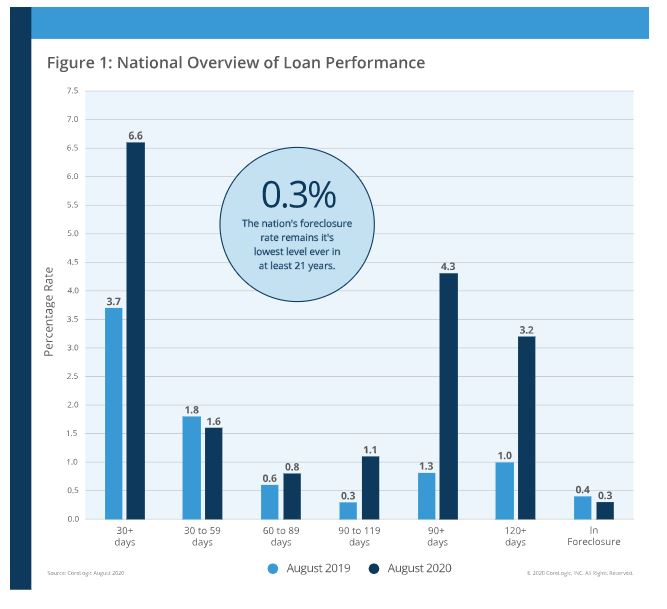

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for August 2020. On a national level, 6.6% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure). This represents a 2.9-percentage point increase in the overall delinquency rate compared to August 2019, when it was 3.7%.

To gain an accurate view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency, including the share that transitions from current to 30 days past due. In August 2020, the U.S. delinquency and transition rates, and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.6%, down from 1.8% in August 2019, and down from 4.2% in April when early-stage delinquencies spiked.

- Adverse Delinquency (60 to 89 days past due): 0.8%, up from 0.6% in August 2019, but down from 1% in July and from 2.8% in May.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 4.3%, up from 1.3% in August 2019. This is the highest serious delinquency rate since February 2014.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% in August 2019. The August 2020 foreclosure rate is the lowest since at least January 1999.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.9%, up from 0.8% in August 2019. The transition rate has slowed since April 2020, when it peaked at 3.4%.

Foreclosure rates remain low, in part due to forbearance programs and other government provisions. However, August 2020 marked a spike in 150-day past-due loans, reaching a historic high of 1.2%, likely due to large volumes of delinquencies moving in tandem through the pipeline. Homeowners nearing the end of the first 180-day grace period (afforded to borrowers with federally backed mortgages) can request an extension of an additional 180 days, which is keeping foreclosure rates low while serious delinquency continues to climb. However, back-mortgage payments continue to add up for those unable to exit forbearance periods early. Looming unpaid mortgage payments, paired with sharp declines in income for many families, point to a potential wave of home sales triggered by financial distress in 2021 as forbearance periods end.

“Forbearance programs continue to reduce the flow of homes into foreclosure and distressed sales and has been the key to helping many families who have been particularly hard hit by the pandemic," said Frank Martell, president and CEO of CoreLogic. "Even though foreclosure rates are at a historic low, the spike in 150-day past-due loans points to bumpy waters ahead...”