CoreLogice Reports An Emerging Paradox: U.S. Serious Delinquencies Spiking Despite Strong House Demand

- The U.S. serious delinquency rate reached its highest level since April 2014

- Metropolitan areas that lack strong job return led the nation in delinquencies in July

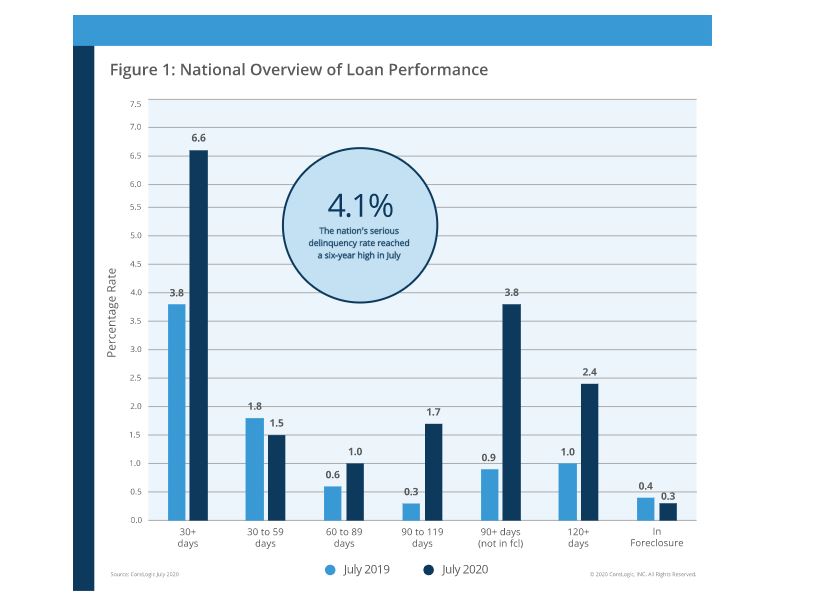

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for July 2020. On a national level, 6.6% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure). This represents a 2.8-percentage point increase in the overall delinquency rate compared to July 2019, when it was 3.8%.

To gain an accurate view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency, including the share that transitions from current to 30 days past due. In July 2020, the U.S. delinquency and transition rates, and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.5%, down from 1.8% in July 2019, and down from 4.2% in April when early-stage delinquencies spiked.

- Adverse Delinquency (60 to 89 days past due): 1%, up from 0.6% in July 2019, but down from 2.8% in May.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 4.1%, up from 1.3% in July 2019. This is the highest serious delinquency rate since April 2014.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, down from 0.4% in July 2019. The July 2020 foreclosure rate is the lowest for any month in at least 21 years.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.8%, unchanged from July 2019. The transition rate has slowed since April 2020, when it peaked at 3.4%.

Despite home values, measured by the CoreLogic Home Price Index, rising at an accelerated rate, unemployment levels in hard-hit areas remain stubbornly high, leaving some borrowers house-rich but cash poor. Despite the slow reopening of several sectors of the economy, recovery for other industries like entertainment, tourism, oil and gas have a more uncertain outlook for the remainder of 2020. With persistent job market and income instability, Americans continue to tap into savings to stay current on their home loans. But as savings run out, borrowers could be pushed further down the delinquency funnel...