On the Rise: CoreLogic Reports Annual U.S. Home Price Appreciation Jumped to 5.9% in August

- CoreLogic U.S. Home Price Index annual growth at highest level since June 2018

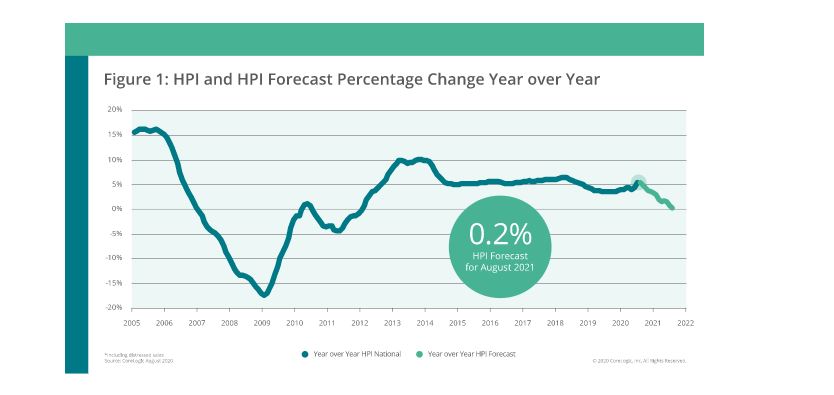

- HPI Forecast predicts home price growth will slow over the 12 months through August 2021 with price declines in 27 states

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2020. Nationally, home prices increased 5.9% in August 2020, compared with August 2019, and the gain was up nearly 1% compared to the prior month, when home prices increased 5.1% year over year.

Despite the continued pressures of the pandemic, consumer home-purchasing power has stayed strong as mortgage rates remain at record lows. Meanwhile, for-sale inventory has continued to dwindle, dropping 17% year over year in August, which created upward pressure on home price appreciation as buyers compete for the limited supply of homes.

“Consumers who have not been as financially impacted by the ongoing economic pressures are taking advantage of low mortgage rates to either break into the market, upgrade their living situations or purchase second homes and investment properties,” said Frank Martell, president and CEO of CoreLogic. “With heightened activity putting a strain on the current for-sale inventory, strong demand should help spur new homebuilding activity.”

Home price growth is expected to slow as greater availability of new and existing homes are placed for sale in 2021 and elevated unemployment saps buyer demand. The HPI Forecast shows prices will start to downshift in early 2021, with annual U.S. HPI gains slowing to just 0.2% by August 2021 and many locations experiencing a decline in prices.

“The imbalance between homebuyer demand and for-sale inventory is particularly acute for lower-priced homes,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Because of this imbalance, homes priced more than 25% below the median were up 8.6% in price over the last year, compared with the 5.9% price increase for all homes...”