Prepare For a Cooldown: CoreLogic Reports Home Prices Were Up in May, But Could Slump over the Summer

- CoreLogic HPI reports a 4.8% increase compared to May 2019, as demand continued to prop up home price growth

- CoreLogic Market Risk Indicator predicts 125 metro areas have at least a 75% probability of price decline by May 2021

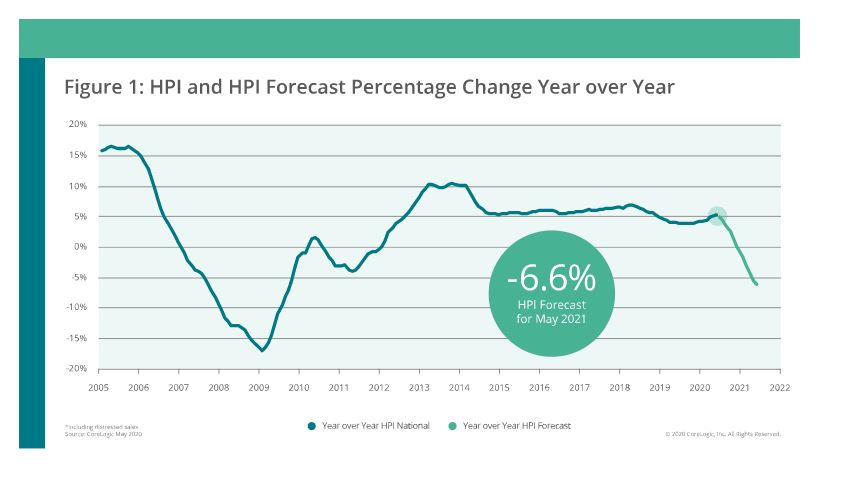

- The HPI Forecast shows U.S. index will tumble 6.6% from May 2020 to May 2021, with all states expected to experience a decline

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for May 2020. Nationally, home prices increased by 4.8%, compared with May 2019. Home prices increased 0.7% in May 2020 compared with April of this year.

Strong home purchase demand in the first quarter of 2020, coupled with tightening supply, has helped prop up home prices through the coronavirus (COVID-19) crisis. However, the anticipated impacts of the recession are beginning to appear across the housing market. Despite new contract signings rising year over year in May, home price growth is expected to stall in June and remain that way throughout the summer. CoreLogic HPI Forecast predicts a month-over-month price decrease of 0.1% in June and a year-over-year decline of 6.6% by May 2021.

Unlike the Great Recession, the current economic downturn is not driven by the housing market, which continues to post gains in many parts of the country. While activity up until now suggests the housing market will eventually bounce back, the forecasted decline in home prices will largely be due to elevated unemployment rates. This prediction is exacerbated by the recent spike in COVID-19 cases across the country.

“Pending sales and home-purchase loan applications are higher than in June of last year and reflect the buying activity of millennials,” said Dr. Frank Nothaft, chief economist at CoreLogic. “By the end of summer, buying will slacken and we expect home prices will show declines in metro areas that have been especially hard hit by the recession...”