What Is Going On in the U.S. Housing Market?

Leading up to the pandemic, the United States housing market was showing incredible resilience, and even promised to be the strongest year since the Great Recession. With some lulls along the way, particularly in late 2018, home sales at the beginning of 2020 reached the highest level since 2008.

The strength of the housing market coming into 2020 was in part due to very low mortgage rates along with scarcity of homes for sale (mostly among affordably priced homes) and strong employment and income growth.

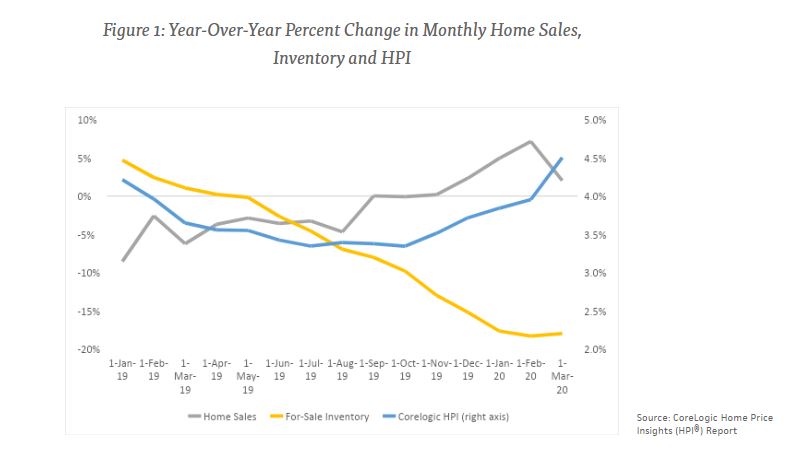

As Figure 1 suggests, a pickup in demand also reinvigorated home price growth, which reached 4.5% year-over-year increase through March, according to the latest CoreLogic Home Price Insights (HPI®) Report.

A Pandemic Changes Everything

And then, COVID-19 happened. In the wake of President Donald Trump’s declaration of a national emergency on March 13 and a number of shelter-in-place orders across the country, most housing market indicators took a turn almost immediately.

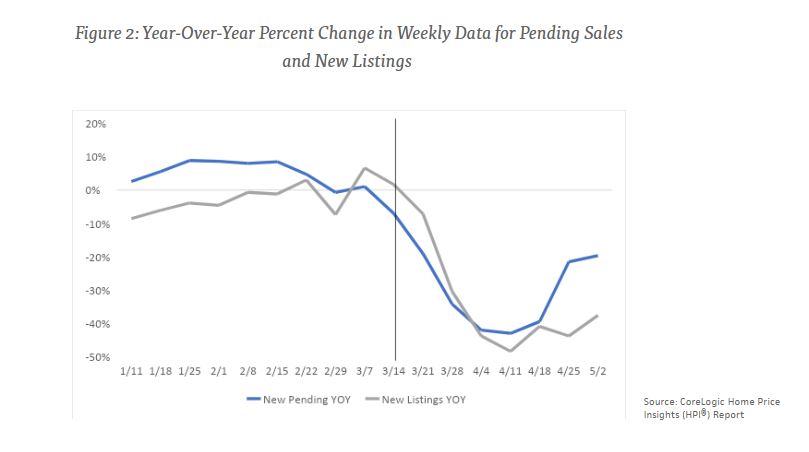

Pending sales, which are considered a leading indicator for sales expected to close in 30 to 45 days, quickly started declining; they fell 40% by mid-April, compared to last year’s levels. New for-sale listings followed a similar trend, also falling by half compared to last year.

Figure 2 illustrates pending sales and new listing trends on a weekly basis since the beginning of 2020. After reaching a trough by mid-April, the two indicators have shown some signs of a turnaround, suggesting that home buyer activity is slowly rebounding. Nevertheless, with such a remarkable pause in home-buying activity throughout April, forthcoming home sales data for April and May will likely show significant declines compared to previous years’ spring buying seasons.

Home Prices Still Stable

While home-buying activity has been severely affected by the pandemic, home price growth has remained relatively steady. That is in large part supported by housing market fundamentals leading up to the pandemic, such as lack of availability of homes for sale and eager first-time home buyers looking to take advantage of historically favorable mortgage interest rates.

Home price growth in April and May is still expected to show a 12-month increase of more than 4%, while the national forecast through March 2021 suggests deceleration of price growth to 0.5%, but no significant decline.

Now, with the high level of uncertainty and economic recovery taking many different shapes, understanding the outlook for the housing market resembles a jigsaw puzzle. Home-buying activity is showing signs of a pickup from a trough as more sellers are willing to put their homes on the market and as more home buyers apply for mortgages and enter into contracts...