Gain for Housing Share of GDP During 1Q20

During the first quarter. GDP growth posted its worst performance since the Great Recession, recording a -4.8% growth rate.

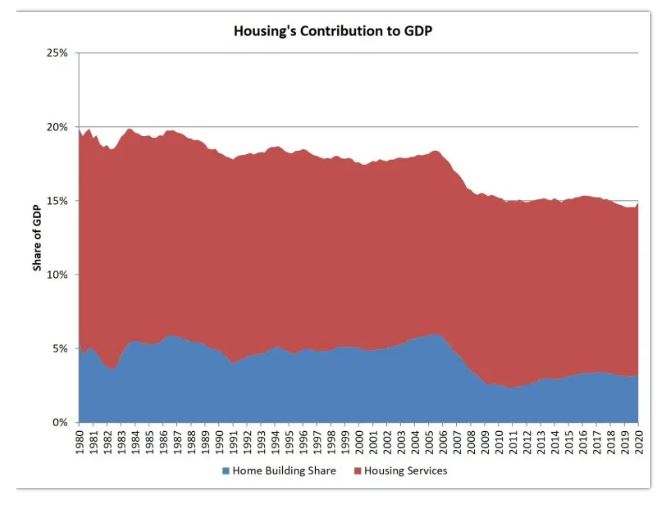

However, housing’s share of gross domestic product (GDP) increased slightly to 14.9%. The home building and remodeling component – residential fixed investment – also increased slightly, rising to 3.3%.

As the economy begins a recovery later in 2020, we expect housing to play a leading role. Housing enters this recession underbuilt, not overbuilt. Estimates vary, but based on demographics and current vacancy rates, the U.S. may have a housing deficit of up to one million units.

And consequences of the virus crisis are likely to lead to a reversal in recent declining home size trends and greater need for additional office space. Thus, home building and remodeling have demand-side potential that can help fuel a recovery in the labor market, given the widespread impact that construction has on the economy in terms of jobs and state/local tax revenue.

Housing-related activities contribute to GDP in two basic ways.

The first is through residential fixed investment (RFI). RFI is effectively the measure of the home building, multifamily development, and remodeling contributions to GDP. It includes construction of new single-family and multifamily structures, residential remodeling, production of manufactured homes and brokers’ fees. For the first quarter, RFI was 3.3% of the economy, reaching a $633 billion seasonally adjusted annual pace (measured in inflation adjusted 2009 dollars).

The second impact of housing on GDP is the measure of housing services, which includes gross rents (including utilities) paid by renters, and owners’ imputed rent (an estimate of how much it would cost to rent owner-occupied units) and utility payments. The inclusion of owners’ imputed rent is necessary from a national income accounting approach, because without this measure, increases in homeownership would result in declines for GDP. For the first quarter, housing services was 11.6% of the economy or $2.2 trillion on seasonally adjusted annual basis.

Taken together, housing’s share of GDP was 14.9% for the quarter...