How Will COVID-19 Impact U.S. Mortgage Performance?

Trends in Home Equity by State

As the coronavirus pandemic continues to wreak havoc on the economy and claims for unemployment insurance reach record highs, homeowners are at increased risk of becoming delinquent on their mortgage loans. For those borrowers in negative equity, risk of foreclosure is even higher.

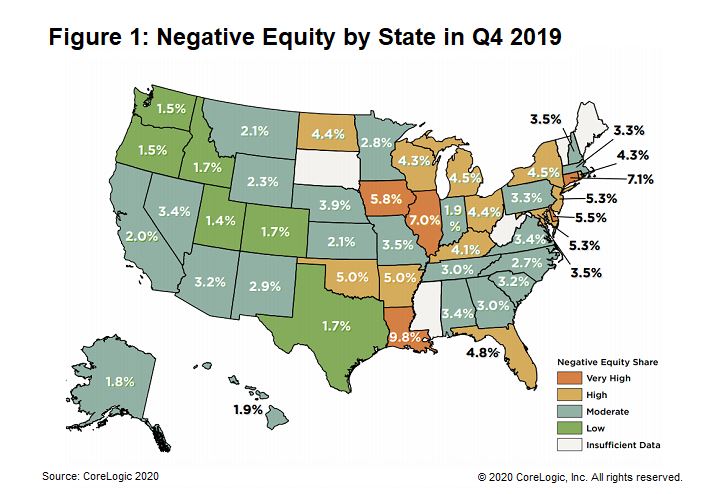

Negative equity across the nation peaked in 2009 after the 2008 financial crisis, with 26% of all mortgaged properties in negative equity. Since then, the negative equity share gradually decreased to 3.5% by the end of 2019. However, in some states (Figure 1), the negative equity share continues to be elevated, notably in Louisiana (9.8%), Connecticut (7.1%), and Illinois (7.0%). Layering job loss on top of negative equity could lead these states to see high rates of delinquency and foreclosure in the coming months, though the CARES act will alleviate some risk from delinquencies and foreclosures to borrowers through forbearance. While claims for unemployment insurance increased across the U.S. starting in mid-March, Louisiana saw claims increase by about 4,600% compared with about 1,900% for the U.S. on average[1].

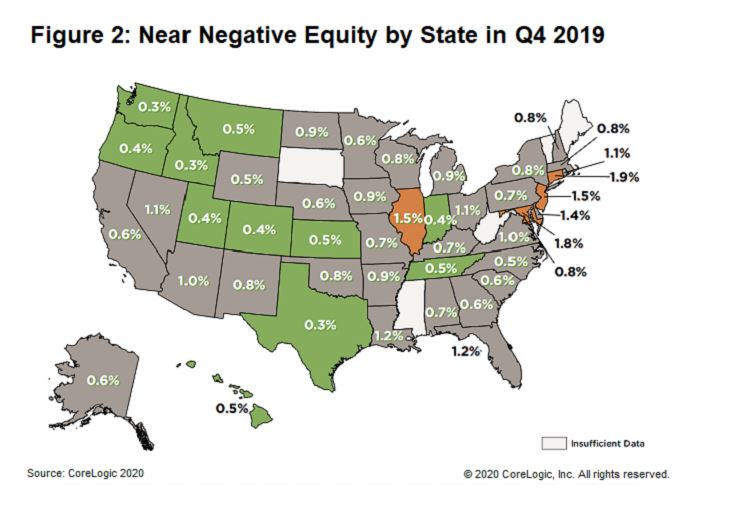

If home prices were to fall, more borrowers would be at risk. In addition to the negative equity share, CoreLogic also tracks the near negative equity share, which is the share of mortgages with less than 5% equity. If home prices fall by 5%, this share will fall into negative equity. While the United States average near negative equity share at the end of 2019 was 0.8%, figures from some states were much higher (Figure 2). If home prices drop by 5%, homeowners in Connecticut (1.9%), Maryland (1.8%), New Jersey (1.5%), and Illinois (1.5%) are the most at risk.