Wealthy Mortgage Borrowers Face Cold Shoulder From Lenders

The wealthiest, most-reliable mortgage borrowers in the U.S. are hearing an unfamiliar word from lenders: No.

The global pandemic has flipped the mortgage market upside down, turning the industry’s most-valued customers into risky bets. When the rich lose income and stop paying, costs for lenders are magnified because the loans -- known as jumbos since they are bigger than most conventional mortgages -- don’t have the government to backstop losses.

“Before this crisis hit us, jumbo loans were pretty attractive,” Tendayi Kapfidze, chief economist at LendingTree Inc., said. “But because they don’t have the government guarantee, a lot of those loans end up on the bank balance sheet.”

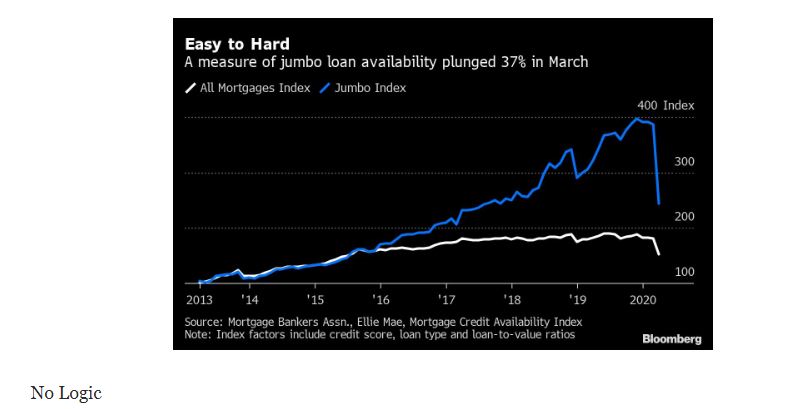

Lenders are charging more for jumbos, relative to conventional mortgages, than at any time in almost seven years, according to Optimal Blue, a Plano, Texas-based company that tracks mortgage rates. They’ve also tightened lending standards, making it harder for households, even those with pristine credit, to qualify for new loans.

David Adler, an aerospace executive in Irvine, California, thought it would be easy to lower the 3.7% rate on his $700,000 home loan. Adler, 60, has excellent credit and plenty of equity in the Spanish Mission-style house he bought new eight years ago. He had watched the Federal Reserve drop its benchmark rate to near zero, but when he called his lender, U.S. Bank, the company’s rates were too high to help. “I told the guy at the bank, ‘I’m trying to use logic here,’” Adler said in an interview. “And he said, ‘That’s your problem...