What is the Impact of a Recession on the Housing Market?

There is a widespread expectation that the US as well as the whole world have entered or will be in recession amid the coronavirus pandemic. Goldman Sachs and JPMorgan forecast a more than 20% US GDP contraction for next quarter[1] . The International Monetary Fund declared a global recession[2] . In this blog, the impact of the past five recessions on regional housing markets is examined and sheds some light on what may occur during this coming recession.

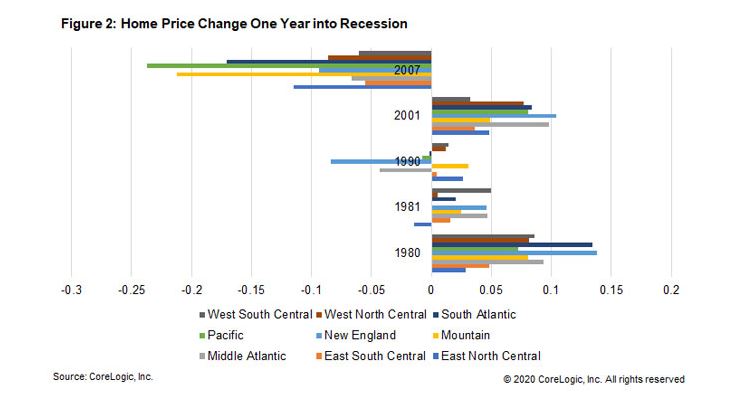

Figure 2 shows the nominal home price change one year into a recession for all census regions. Even after the start of the Great Recession after the December 2007 business cycle peak, the magnitude of the home price depreciation varied region by region, ranging from about a 5% decline in the East South Central region to almost a 25% decline in the Pacific region one year into the recession. The 2001 .com bubble burst recession had never stopped the nominal home price from appreciating in all regions, even in the Pacific region where the .com bubble burst. For the 1990, 1981 and 1980 recessions, most regions had positive home price growth one year into the recession except for three occasions: New England and Middle Atlantic in 1990 and East North Central in 1981...