The Hidden Reason Why House Prices Are Too High

Does the typical appraisal protect you from overpaying for a house? If it doesn’t, what would that mean for house prices in general?

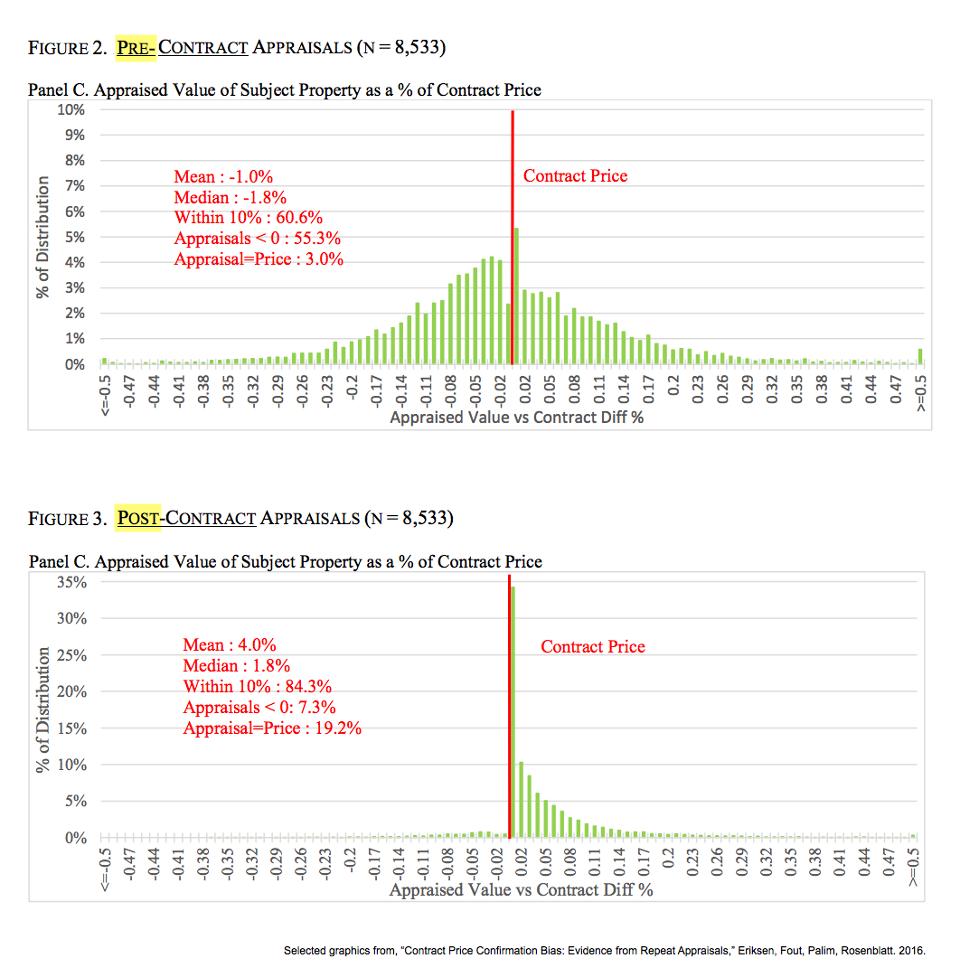

A study looked at a particular set of 8,533 houses that Fannie Mae foreclosed on from 2012 to 2015 and where two appraisals were done on each house. The first appraisals were done right after Fannie took ownership and the second appraisals were done after the houses went under contract to buyers. The second appraisals were the typical lender’s/bank appraisals that are ordered by your mortgage company when you’re in the process of buying a house.

The first and second appraisals were done within six months of each other and no alterations or repairs were made to the houses between the two appraisals. The biggest difference wasn’t the house. The biggest difference in the second appraisal was the appraisers knew what the agreed-upon sales prices were in the sales contracts.

Did knowing the agreed-upon sales prices in the written sales contracts affect how the appraisers appraised the values of the houses? Yes. It did. A lot.

On average, the second appraisals were 4% higher than the first appraisals.

In addition, about half of the first appraisals came in below the eventual sales prices in the contracts but only 7% of the second appraisals come in below the prices in the contracts. They call this phenomenon “appraisal bias” or “confirmation bias.” There’s a strong bias for appraisals to come in at, or above, the sales prices in sales contracts.

Here’s part of the problem. Houses have a fair market value price range, not a fair market value price down to the dollar. House appraisals, however, have to be down to a single dollar amount. If a lender’s appraisal comes in lower than the contract price, by even $1, it causes a ton of extra work for the mortgage company (that hired the appraiser) and can be a huge problem for the buyer and seller.

Lender’s appraisals are usually done late in the sales process which makes the disruption caused by appraisals below the agreed-upon sales prices far worse. Sellers may have already moved out. Buyers may have already sold their houses or canceled their current leases. Because of that, appraisers rarely come in with appraised values that are just below the agreed-upon prices in the contracts...